The Four Types of Multifamily Apartment Investments: Core, Core Plus, Value Add, and Opportunistic

|

September 20, 2023

|

Introduction

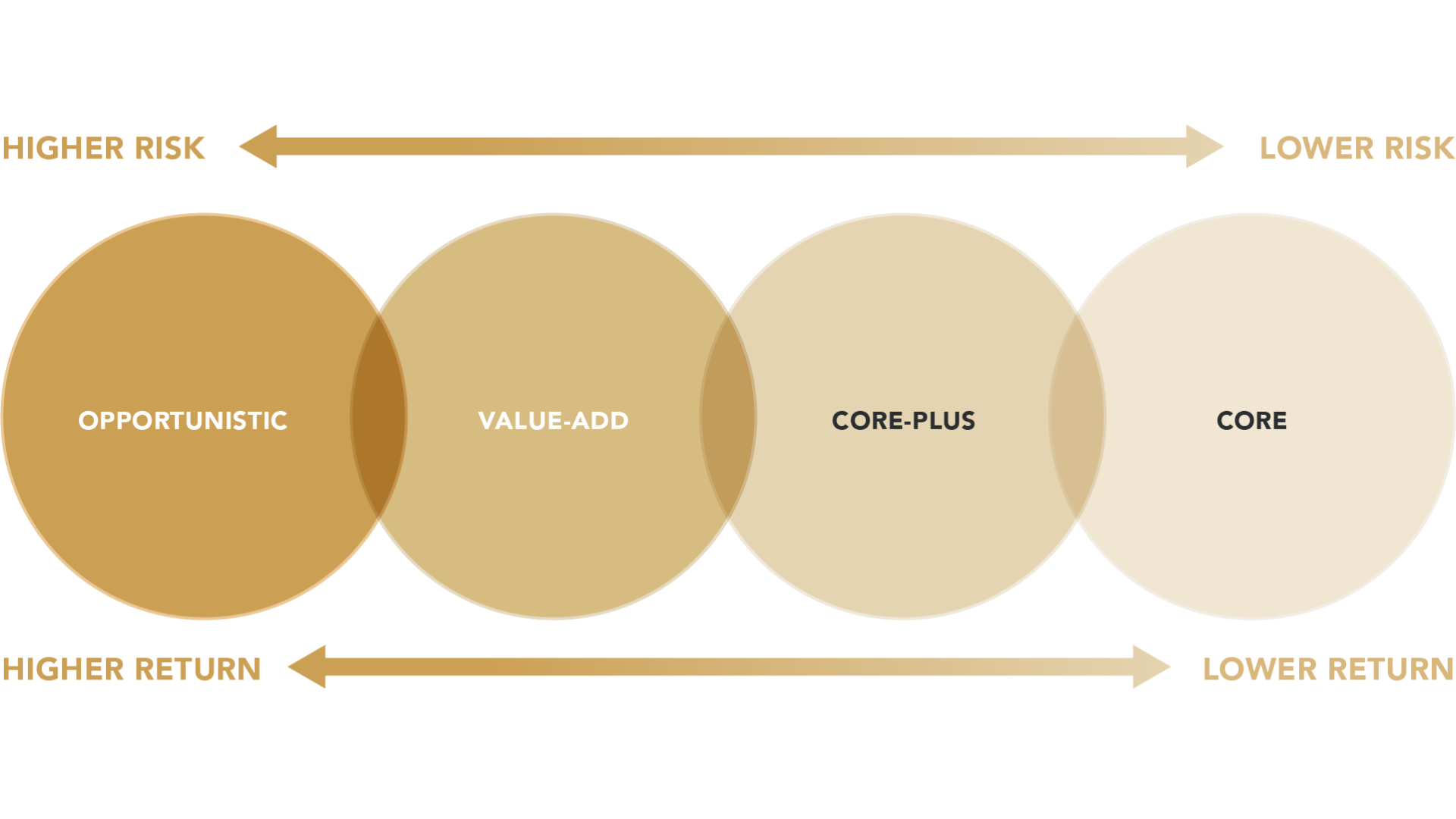

Real estate investments, specifically in multifamily apartments, have proven to be a rewarding choice for many high-net-worth Canadian investors looking to diversify their portfolios in the US market. However, not all multifamily apartment investments are created equal. They are categorized into four primary types: Core, Core Plus, Value Add, and Opportunistic. Understanding these categories will empower you to make informed investment decisions that align with your risk tolerance and financial goals.

Real estate investments, specifically in multifamily apartments, have proven to be a rewarding choice for many high-net-worth Canadian investors looking to diversify their portfolios in the US market. However, not all multifamily apartment investments are created equal. They are categorized into four primary types: Core, Core Plus, Value Add, and Opportunistic. Understanding these categories will empower you to make informed investment decisions that align with your risk tolerance and financial goals.

Core Investments

Core multifamily apartment investments are the “blue-chip” assets of real estate. They’re typically high-quality, well-located properties in top-tier cities. These properties are already performing well and producing stable cash flow. The idea is to preserve wealth and provide steady, albeit lower, returns—usually in the range of 5% to 10%. Core investments are ideal for conservative investors who prioritize stability and income over higher returns.

Core Plus Investments

Core Plus Investments are one step up the risk-return ladder. These properties are similar to core investments but may require a bit of light renovation or improved management to boost their performance. Core Plus properties are typically located in desirable areas and show potential for moderate appreciation. They offer slightly higher potential returns compared to core investments—generally between 7% and 12%. Core Plus investments are perfect for investors seeking a balance between risk and reward.

Value-Add Investments

Value-Add Investments involve a more aggressive strategy. These properties usually require significant improvements or have operational inefficiencies that, once addressed, can significantly increase their cash flow and value. Renovations may include upgrading interiors, enhancing amenities, or making energy-efficient modifications. While there’s a higher level of risk involved, the potential returns can range from 12% to 18%. Value-Add investments are suitable for investors looking for higher returns and comfortable with taking on additional risk.

Opportunistic Investments

Opportunistic investments represent the highest risk and potential return category. These properties often need extensive development or redevelopment and can even involve raw land development. The risks include construction, market, and leasing uncertainties, but the potential returns can exceed 20%. Opportunistic investments are most appropriate for experienced, high-risk-tolerance investors seeking substantial capital appreciation.

Conclusion:

There’s a wide spectrum of multifamily apartment investment types, each with its risk and return profile. Understanding these categories—Core, Core Plus, Value Add, and Opportunistic—can help you match your investment with your financial objectives and risk tolerance.

Keep in mind that regardless of the category, the success of a multifamily apartment investment greatly depends on market timing, asset management, and the expertise of the syndication team.

Ready to explore multifamily investment opportunities in the US? Reach out to us. Let’s discuss which type of multifamily investment is most suitable for your financial goals and risk appetite.

Download our free e-book “The Full Out® Apartment Investor” to learn more about Multifamily Investments. Click here to download now!

Ready to connect?

Book a call with our investor relations team today to learn more about current investment opportunities.

Have a question?

Please use the form below to contact us. We will never spam you, or sell your email to third parties.