Selecting the Ideal Market for Investing in Multifamily Properties

|

FEBRUARY 23, 2024

|

Introduction:

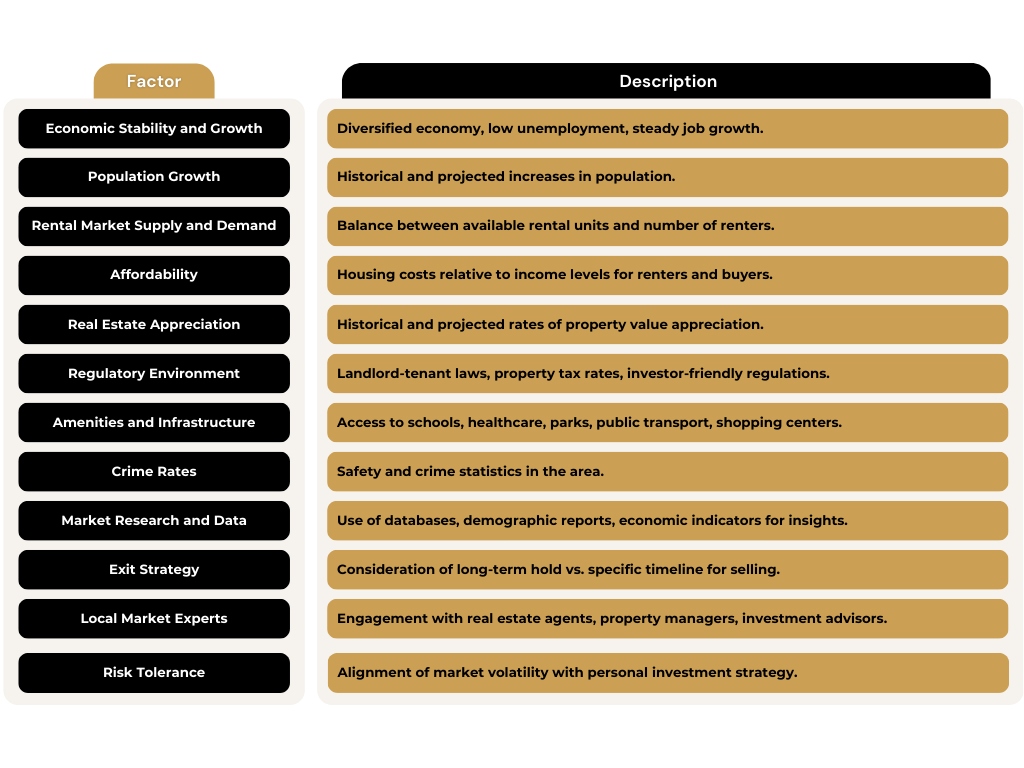

Making the right choice of market is crucial for achieving success in multifamily real estate investments. To ensure you’re making a well-informed decision, focus on these essential aspects when scrutinizing potential markets:

Economic Vitality and Prospects

Delve into the economic resilience and growth prospects of each market. Favor those with diverse economies, low joblessness, and a track record of consistent employment growth. Strong employment sectors generally mean a greater need for rental accommodation.

Demographic Expansion

The growth of the population is a key sign of a thriving multifamily market. Look for cities or regions with rising populations, as this usually signals a growing need for rental homes. Examine both past and forecasted demographic data to pinpoint areas with promising trends.

Supply vs. Demand in the Rental Market

Evaluate the equilibrium of rental housing supply against demand. Markets with a rental unit shortfall relative to the renter population often experience higher occupancy and rent increases, presenting a lucrative opportunity for investors.

Market Affordability

Take into account the affordability for both tenants and investors. Markets where housing expenses are well-balanced with income levels tend to attract and keep tenants, whereas overly expensive rents can cause high turnover and vacancies.

Property Value Growth

Look into the past and the anticipated appreciation of property values. Areas with steady property value increases are likely to offer long-term worth and opportunities for equity expansion.

Regulatory Climate

Investigate the local regulatory landscape, including laws affecting landlords and tenants, as well as property taxation. Markets with investor-friendly policies and advantageous tax situations are more appealing for multifamily investments.

Lifestyle and Infrastructure

Assess the area’s livability, including the availability of amenities such as educational institutions, medical facilities, green spaces, public transport, and shopping venues. These factors can make your properties more desirable.

Safety Metrics

Analyze crime rates to gauge the safety of potential markets. Locations with lower crime rates tend to ensure tenant contentment and the enduring prosperity of your investments.

In-depth Market Analysis

Employ various tools and data sources for market research to obtain a well-rounded view of prospective markets. Utilize real estate databases, demographic analyses, and economic indicators for deeper insights.

Strategic Exit Planning

Consider your exit strategy beforehand, whether you aim for long-term income or plan to sell within a specific timeframe. The market’s growth outlook should be in line with your investment objectives.

Insights from Local Professionals

Connect with local experts, such as real estate brokers, property management professionals, and investment consultants. Their local knowledge can be invaluable in understanding market nuances.

Risk and Investment Timeline Consideration

Evaluate your comfort with risk and the timeline of your investment. Some markets might offer higher potential rewards but with increased risk, while others may be more stable but yield lower immediate returns. Your risk appetite should match your investment approach.

In summary, identifying the optimal market for multifamily investments requires a detailed examination of economic indicators, demographic shifts, market supply and demand, and local factors. Comprehensive research and careful due diligence are key to making a choice that enhances your chances of success in the multifamily real estate sphere.

Interested in investing in multifamily apartments? Explore our newest multifamily apartment offering in Charleston, South Carolina.

Ready to connect?

Book a call with our investor relations team today to learn more about current investment opportunities.

Have a question?

Please use the form below to contact us. We will never spam you, or sell your email to third parties.